2026-02-14 · 4 min read

AI's Great Divide: Why Vertical SaaS Commands a Premium Valuation in 2026

The AI Valuation Bifurcation: Not All SaaS Is Created Equal As of early 2026, the initial exuberance surrounding generative AI has matured into a more discerning market focus. The critical question for equity analysts is...

The AI Valuation Bifurcation: Not All SaaS Is Created Equal

As of early 2026, the initial exuberance surrounding generative AI has matured into a more discerning market focus. The critical question for equity analysts is no longer "Does this software company use AI?" but rather "Does AI fortify this company's competitive moat?" This shift has created a significant valuation bifurcation in the SaaS sector. We're observing premium enterprise value to next-twelve-months (EV/NTM) revenue multiples (10x+) for vertical SaaS leaders, while many horizontal SaaS players languish at compressed multiples (sub-6x) due to perceived commoditization risk. Understanding this divide is key to identifying durable growth opportunities.

The Vertical SaaS Fortress: The Case for Veeva Systems

Vertical SaaS companies, which serve specific industries, are demonstrating remarkable resilience. A prime example is Veeva Systems (VEEV), the dominant cloud platform for the global life sciences industry. Their moat isn't just software; it's a combination of deep regulatory expertise, proprietary industry data, and workflow integration that is incredibly difficult for a general-purpose AI to replicate. AI, for Veeva, is not a threat but an enhancement, allowing them to deliver more powerful, data-driven insights within their existing ecosystem. This "AI defensibility" is why the market is willing to award VEEV a premium valuation. You can explore their full financial profile on the Edwyn company deep-dive page for Veeva Systems.

The Horizontal Squeeze: Asana and Commoditization Risk

Conversely, consider a horizontal SaaS company like Asana (ASAN), which provides project management tools across many industries. While Asana has integrated AI features to improve its product, its core functionality is facing an existential threat from hyperscalers like Microsoft and Google. As AI assistants become more deeply embedded in core productivity suites (e.g., Microsoft 365 Copilot, Google Workspace), the need for a standalone, horizontal project management tool may diminish for many customers. This risk of being commoditized or bundled away by larger platform players is a primary driver of the multiple compression seen in this segment. The market is signaling uncertainty about their long-term pricing power and competitive positioning.

A Practical Workflow: How to Analyze the SaaS Divide in Edwyn

Discerning investors can use Edwyn to systematically validate this thesis and find opportunities.

- Start with a Head-to-Head Comparison: The most direct way to see the trend is to compare the key players. Use the Edwyn Stock Pair Comparison tool for VEEV vs. ASAN. Immediately, you can chart the divergence in their EV/NTM Revenue multiples and other critical operating metrics over time.

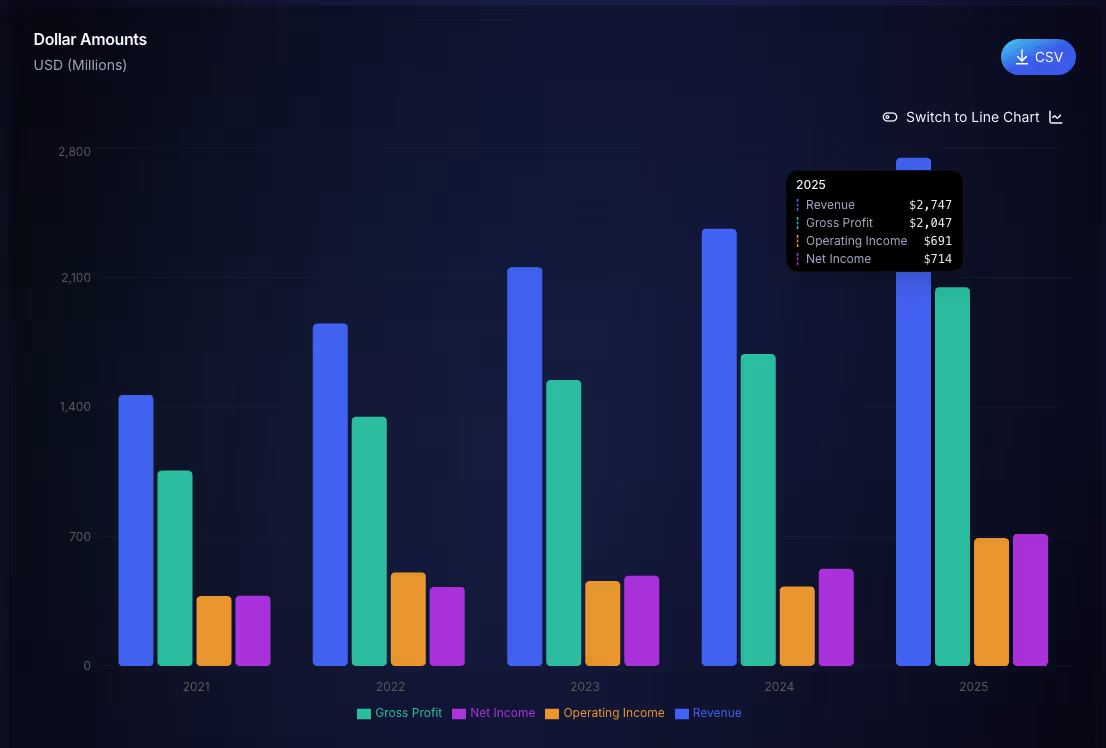

- Scrutinize Financial Health for Moat Indicators: A premium multiple must be supported by superior financials. Navigate to the individual company pages using Edwyn's search. For a company like Veeva, look for consistently high gross margins (>70%), indicating strong pricing power, and sustained R&D investment as a percentage of revenue, which fuels product leadership. These are hallmarks of a durable competitive advantage.

- Expand Your Search for Similar Patterns: Use this framework to find other companies exhibiting similar characteristics. The Underpriced Stocks screener allows you to filter by industry (e.g., Software) and key valuation metrics to surface other potential vertical champions or undervalued horizontal players that may be bucking the trend. For a full-scope analysis, you can generate a complete Valuation Report on any target.

Veeva's superior gross margins and consistent R&D spend, easily viewed in Edwyn, are financial proof of its strong market position.

Veeva's superior gross margins and consistent R&D spend, easily viewed in Edwyn, are financial proof of its strong market position.

Conclusion: In the AI Era, Defensibility Demands a Premium

The bifurcation in SaaS valuations is a rational market response to the evolving technological landscape. AI is acting as an accelerant, rewarding companies with deep, defensible moats built on proprietary data and specialized workflows, while punishing those whose value proposition can be easily replicated. For analysts and investors, the key is to look past the AI buzzwords and use robust tools to analyze the underlying strength and durability of the business model. The companies that can prove their indispensability in the age of AI will continue to command premium valuations and deliver long-term value.

Apply This in Edwyn

Put this analysis into practice using Edwyn's core valuation toolkit:

- Compare Stocks: Use the stock comparison tool to place companies like VEEV and ASAN side-by-side. Instantly visualize disparities in valuation multiples, growth rates, and profitability.

- Search Public Companies: Access detailed financial statements, key metrics, and historical data for any public company. Use the search bar to quickly pull up a target like Veeva to begin your deep dive.

- Enterprise Value Calculator: Before analyzing multiples like EV/Revenue, ensure you understand their components. Use the Enterprise Value Calculator to bridge a company's market cap with its debt and cash position to fully grasp its capital structure.

- Compare Stocks: Compare two public companies to spot valuation gaps and underpriced opportunities.